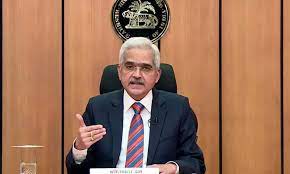

The three-day meeting of the Reserve Bank of India's (RBI) monetary policy review is starting today. It is expected that the central bank may increase the repo rate by 0.50 percent on 30 September. If this happens, the repo rate will go down to 5.90 percent, from 5.40 percent now. Last week alone, about a dozen central banks raised interest rates. Bank of America had gained 0.75 percent.

To control inflation, central banks around the world have adopted the strategy of raising interest rates. Despite this, inflation rates are above their targets. The rate of retail inflation in India is 7 percent while RBI's target is 2 to 6 percent. It has increased interest rates by 1.40 percent three times since May.

Know what experts say

Keeping in view the recent developments in the foreign exchange market, RBI may also increase the policy rates by 0.50 percent. -Madan Sabnavis, Chief Economist, Bank of Baroda

The repo rate is set to increase by 0.50 percent. Its peak rate will go up to 6.25 percent and the final growth will be 0.35 percent in December. -SBI

In Solapur, Maharashtra, 7 devotees were killed and several others were injured after they were h

A banquet dinner was organized during the BRICS summit on Wednesday. Prime Minister Modi was the

RCB vs DC, WPL 2023. In the match played at DY Patil Stadium in Navi Mumbai on 13 March, Delhi Ca

India has not lost any series to South Africa in T20 in the last five years. The first match of t

Who did Saint Premanand first enthrone? He prostrated himself before him and had his feet washed.

This is the eternal tradition: when two prominent practitioners from different sects met, not onl

Kantara Chapter 1: Jr NTR praises 'Kantara Chapter 1', calls Rishabh Shetty a mix of actor-director

Rishabh Shetty's upcoming film "Kantara: Chapter 1" continues to generate considerable buzz. Audi

Drone Attack In Iran: Iran blames Israel for the drone attack, threatens to retaliate

Iran on Thursday blamed Israel for the drone attack. Let us tell you that on Saturday, Iran's def

US Visa Fee Increase There is bad news for those planning to go to America. The US State Departme

There is a wave of mourning in the whole country due to the death of former Prime Minister Manmoh

Jagat Singh, BJP district head of Bharatpur in Rajasthan, has given a controversial statement reg