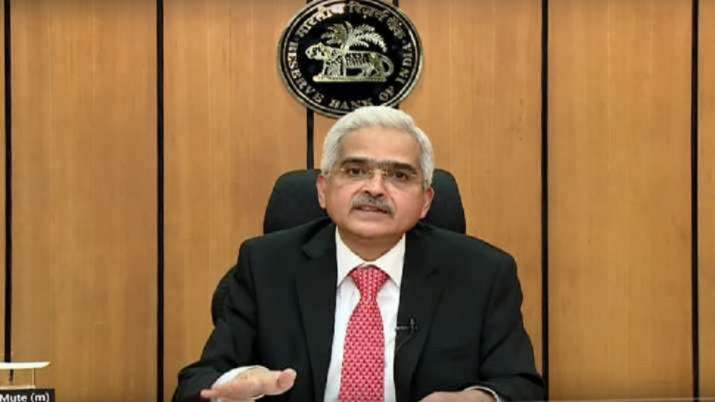

The meeting of the Monetary Policy Committee of the Reserve Bank of India will begin today. The central bank can implement some policy decisions during this meeting. It is expected that after this meeting, which lasted for three days (August 3 to August 5), RBI Governor Shashikant Das will announce the decisions taken during the MPC meeting on August 5. RBI can increase the repo rate once again in this meeting. Let us tell you that in the last MPC meeting, it was decided to increase the repo rate. In the MPC meeting held in May, the repo rate was increased by 50 basis points to 4.90%.

If experts are to be believed, this time also RBI can increase the repo rate by 0.25% to 0.35%. Let us tell you that the rate of inflation in the country is still above the target set by RBI. To control this, the decision to increase the repo rate can be taken once again during the MPC meeting.

Inflation over 7.1%

Let us inform you that the rate of inflation in June was 7.01%. For the sixth time in a row, the rate of inflation has exceeded the RBI's fixed limit of 6 percent. Earlier in May, the retail inflation rate was 7.04. On the other hand, the central bank RBI has also increased the inflation rate for the year 2022-23 from 5.7 percent to 6.7 percent.

How does the repo rate work?

The Reserve Bank of India uses the repo rate to control the flow of money in the market. When the market is in the grip of inflation, the RBI increases the repo rate. The increased repo rate means that the banks which take money from RBI will be made available that money at an increased rate of interest. In such a situation, due to an increase in interest rate, banks will take less money from RBI and the flow of money in the market will remain under control. If banks take a loan from RBI at an expensive rate, then they will also issue loans to common people at an expensive rate. Due to this, the EMI of the common man will be expensive. Because of this, people will take fewer loans and spend less. This will reduce the demand in the market and will help in controlling inflation throughout the process.

Also Read: GST: Rs 1,48,995 crore GST collection in July, 28% increase over last year

Pakistan Floods: America came forward to help Pakistan, sent from food to bed

Pakistan is currently in the grip of heavy rains and severe floods. All the countries around the

Maldives Vs Lakshadweep: The lakshadweep vs Maldives dispute has been in the headlines for quite

Rajasthan Royals were knocked out of IPL 2024 by defeating Royal Challengers Bangalore by 4&

Cyber Security Course: UGC Directives - Start Cyber Security Courses in Universities, Colleges

Cybercrime is spreading day by day in our society. Every day there are cases of cyber fraud by so

The Shraddha murder case in Delhi has shaken the entire nation. The screams of this gruesome mass

NEET UG Counseling: The process of registration for National Eligibility cum Entrance Test / NEET

After the defeat in the World Test Championship final against Australia, Indian captain Rohit Sha

17 seasons passed, Royal Challengers Bangalore's dream of winning the trophy for the first time c

Devastating floods in Pakistan have engulfed a third of the country. One-third of Pakistan has be

Maulana Shahabuddin Razvi, President of All India Muslim Jamaat, has strongly objected to cricket