After a few months of lockdown due to coronavirus infection, the country was allowed to reopen in June, but the challenges for thousands of small entrepreneurs in western Uttar Pradesh city of Meerut remain the same. Businesses ranging from clothing, sports goods, and furniture are closed or run at all. Cows are seen roaming around on those roads which were usually lined with workers and vehicles.

Prime Minister Narendra Modi's $ 40 billion government-guaranteed loans to make small businesses self-reliant is also falling short. About three dozen entrepreneurs across the country say that this debt may not be enough to save many companies that form the backbone of India's economy.

Some say that the pandemic has affected business a lot, in such a situation, they do not understand any meaning of taking a new loan. According to him, instead, the government could help them by cutting the Goods and Services Tax (GST) or by waiving interest on the debt. Some others say that Modi promised to open a credit line but despite this, it was difficult to convince the bankers to give loans because of the risky situation in their business.

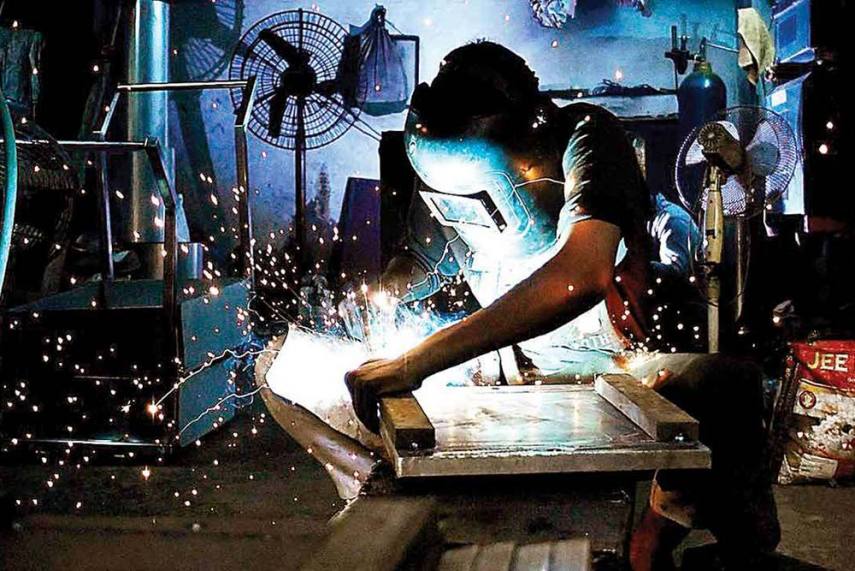

Ashok has an annual turnover of about Rs 1 crore in Meerut, which makes steel furniture for hotels and schools. He says that he had to take eight of his 10 workers out of work and is now thinking of stopping his job. Ashok says on the condition of not saying his full name, 'It would be better for me to stop work. After all, why take more risk to borrow. ' He said that his banker told him that his creditworthiness was low because his business was in a high-risk situation.

The finance ministry had offered a loan assistance scheme to help small and medium-sized businesses facing lockdown. However, the Ministry did not respond to requests from businessmen to comment on questions related to the problem.

Small businesses contribute nearly one-fourth to the country's $ 2.9 trillion economy and employ about 500 million people, the worst affected by the epidemic. In a letter to Prime Minister Modi's office, the Consortium of Indian Associations said that about 35 percent of the 65 crore small businesses across the country could be closed soon without government help.

Lending pressure

Bankers say that there is pressure from the government to give loans to entrepreneurs but businessmen are not coming forward for this and in such a situation the demand for loans is very less. According to government data, bankers have paid about Rs 561 billion so far, accounting for just 19 percent of the sanctioned loans, while loans worth Rs 1,145 billion have been approved since the third week of May. Traders say that banks are either asking for more paperwork or those who are looking more needy are being considered ineligible.

An entrepreneur in Modi's home state of Gujarat said, "I was also asked to provide some security as a security for taking a loan and insurance while it is considered a bail-free loan."

But two bankers said that it is not easy to make money from the government even in the fully supported sovereign guarantee scheme. A former corporate head of a state-run bank said, "My experience was not good". He says, "You lend to most of these businesses only because the government has given instructions for this, but when it comes to withdrawing money, one has to spend resources thoughtfully."

Businesses are in a bad state as their suppliers have not paid and orders have reached zero levels, while fixed costs such as electricity, wages, and installments of earlier bank loans also drain their capital.

In Meerut, apparel manufacturer Sanjeev Rastogi is running his factory with 25 percent of the production capacity, saying, "We have not got a relief of even a rupee from the government".

Rastogi has suffered a loss of three and a half lakh rupees in the last two months and believes that he may have to close his business for the next three months.

Anurag Aggarwal, president of the Meerut Chapter of the Indian Industry Association, said that out of the more than 10,000 textile units in Meerut, about 25 percent of small factories may close in the next few months and will not be able to repay bank loans. Rastogi is making his last attempt to stay in business. He says, "If something does not come back on track, I will sell the factory at any cost and save some money for my retirement."

The Indian Space Research Organisation (ISRO) today launched the highly confidential hyperspectra

Bollywood actor Ranveer Singh's name is taken among those actors who have made a distinct identit

Saudi Arabia accepts its role between India and Pakistan

Saudi Arabia's Deputy Foreign Minister Adel al-Zubair has admitted that Saudi Arabia is trying to

Defense Minister Rajnath Singh has said that not only adequate financial resources are necessary

The first Indian Biological Data Center (IBDC) in the country has been set up in Faridabad, adjac

Among the 14 amendments accepted by the Joint Committee (JPC) of Parliament on the Waqf (Amendmen

US Secretary of State Antony Blinken said that his meeting with India's Foreign Minister S Jaisha

The country has found another weapon to fight the epidemic amid Corona's record cases. The centra

US President Joe Biden has expressed regret over the incident at New York's Brooklyn subway stati

Anti-hijab protests in Iran spread to more than 35 cities for the 12th day on Tuesday. The fear o